ERPNext for FinTech - Loan Management and Invoice Discounting

ERPNext loan module offers loan application, collateral, disbursal, payment, and closure management. It also automates interest and penalty calculations.

Loan Management

1. Vocabulary

Traditionally, to get a loan consumers need to do a lot of paperwork and also visit the offices of lenders multiple times. Digital lending is changing that. Now lenders are digitizing the whole process to improve the experience of the borrowers.

The loan management module in ERPNext offers features to manage loan applications, security management, approvals, disbursement, interest and penalty calculation, repayment, etc.

1.1 Lenders and Borrowers

The lender is the one who is paying the money as a loan. For example, a bank that is granting a loan to a home buyer. The borrower is the one who is receiving money. For example, an individual buying a home or a business borrowing money to expand the business.

1.2 Secured and Unsecured Loans

A loan granted against an asset owned by the borrower is a secured loan. For example, a loan granted against valuable metals like gold or an immovable asset like a house is a secured loan. Such an asset is called a collateral. If the borrower fails to repay the loan, the lender will liquidate the asset and recover the loan amount.

If the loan is granted without any pledging of an asset of the borrower that is known as an unsecured loan. Unsecured loans are inherently riskier than secured loans.

1.3 Pledging and Unpledging.

When a loan is secured against collateral, the collateral is pledged. When pledged, the asset continues to be owned by the borrower, but the lender will have the legal right to liquidate the asset and recover the loan amount when the borrower fails to repay the loan.

1.4 Haircut Percentage and LTV

The Loan-To-Value Ratio expresses the ratio of the loan amount to the value of the security pledged. A loan security shortfall will be triggered if this falls below the specified value for any loan.

Haircut percentage is the percentage difference between the market value of the Loan Security and the value ascribed to that Loan Security when used as collateral for that loan.

1.5 Term Loan and Demand Loan

A term loan has a fixed repayment schedule attached to it. Whereas a demand loan has no such repayment schedule and the lender can ask for repayment as per his/her requirement.

2. Setting Up Loan Management Module

2.1 Loan Security Types

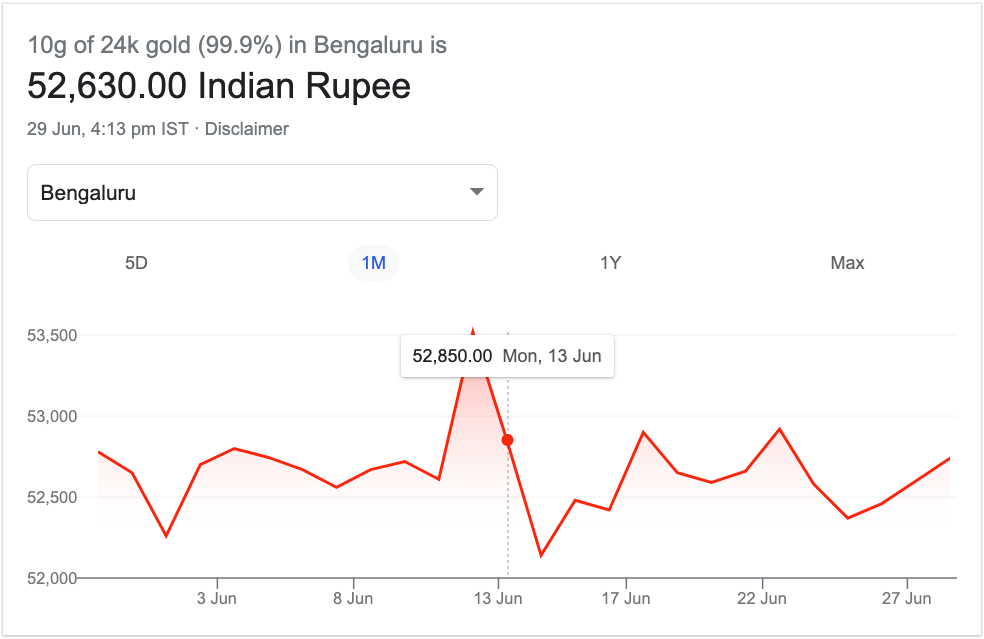

Assets like gold, shares, property are pledged as collateral. A 'Loan Security Type' specifies details like Loan-To-Value-Ratio (LTV) and Haircut. The value of assets pledged as collateral fluctuates and poses a risk to the lender. For example, the value of one gram of gold could be $60 at the time of pledging, but it may crash to $50 later. Such fluctuation may lead to a situation where the current value of the collatoral is less than the loan granted.

2.2 Loan Types

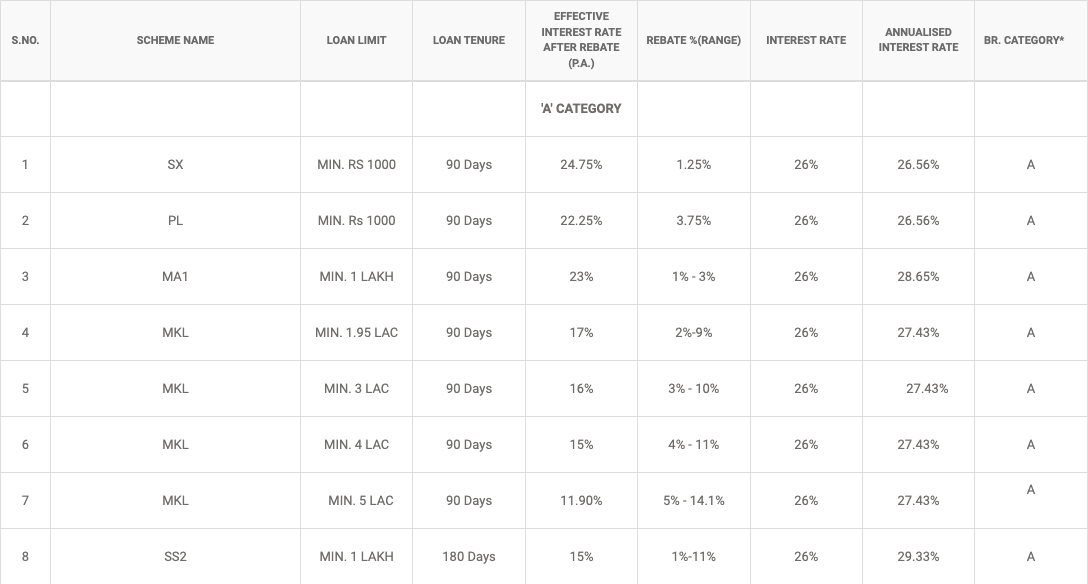

The lender may offer multiple loan types with varying interest rate, maximum loan amount, tenure and borrower category for different segments of the market. The below image shows a few loan types offered by a commercal lender.

2.3 Loan Security Price

Loan security price specifies the price of loan security and validity of the price. Below is the screenshot of the price of 10 gram sof gold over a period of one year.

3. Loan Process

3.1 Loan Application

The loan application captures the applicant details, type of loan needed, loan amount, repayment method, etc. The aplications needs to be reviewed and either approved or rejected.

3.2 Loan Security Pledge and Loan

Once the loan application is approved, the 'Loan Security Pledge' and 'Loan' records are created. The loan record contains the details like loan amount, interest rate, repayment period, total interest payable, and the repayment schedule.

3.3 Loan Disbursal

A 'Loan Disbursal' record is created once the loan amount is paid to the customer.

3.4 Loan Interest Accrual

A background job runs on a daily basis to create the 'Loan Interest Accrual' to update the interest amount accrued for each loan. A 'Process Loan Interest Accrual' record can be created manually to post interst accruals as of any specific date.

3.5 Loan Repayment

A 'Loan Repayment' record is created whenever the borrower proceses a payment towards to loan repayment.

3.6 Loan Security Unpledge and Closure

The borrower can request for loan closure after repaying the loan amount fully. The status of the loan record changes to 'Loan Closure Requested'. After completing all the verifications, a 'Loan Security Unpledge' record can be created, and the collateral can be released to the customer.

4. Loan Security Shortfall

If the market value of the asset pledged as collateral drops then additional collateral is required to secure the loan. When the price of the collateral changes a new 'Loan Security Price' record can be created. A background job runs daily to automatically process the shortfall. A 'Process Loan Security Shortfall' record can be created manually to trigger a shortfall. The borrwer will have to either pay the shortfall amount or pledge additional security to cover the shortfall.

5. Reports

The 'Loan Repayment and Closure' report shows the latest repayments and loan closures, and the 'Loan Security Status' report gives an overview of the status of loan pledges.

6. Invoice Discounting

Fast growing companies may need to raise capital to fund their growth. Invoice Discounting is a mechanism to get short term loans by pledging unplaid invoices as collateral to lenders.

ERPNext offers features to manage pledging invoices, disbursals, payments and closing of loans.

On interest computation, does the system use actual days or it runs a fixed 360/365 days year?

On daily interest accrual, we would like the interest accrual to be based on the loan account balance at the end of the previous day.is this possible ?

On interest processing, can there be an option to automate the process?

wanted to ask how do we contact you if l need any assistance with the loan module