Strategic Financial Management Through Period Closing Vouchers

An indispensable instrument within the accounting domain, facilitating the systematic closure of fiscal periods. Ensuring the precision of financial records and supporting sustainable growth trajector

Introduction

A Period Closing Voucher constitutes a pivotal mechanism within the discipline of financial accounting, enabling the conclusive determination of profit or loss over a defined fiscal period. This instrument symbolizes the reconciliation of accounts for the specified interval and facilitates the initiation of a fresh accounting cycle. The implementation of this procedure is indispensable for preserving the integrity of financial records and adhering to standardized accounting practices.

Rationale for the Utilization of a Period Closing Voucher

The closure of accounting books at the culmination of a fiscal period represents an essential practice to ascertain a company's net financial performance. The Period Closing Voucher fulfills this critical function by:

- Nullifying the balances of all Income and Expense accounts.

- Redirecting the resultant net profit or loss to a predetermined Closing Account.

This methodological approach ensures the fidelity of financial statements, enables the compartmentalization of accounting periods, and facilitates meticulous tracking of financial activities over successive intervals. Furthermore, it aligns organizational financial reporting with statutory mandates and regulatory frameworks.

Taxonomy and Allocation of Retained Earnings, Reserves, and Surplus

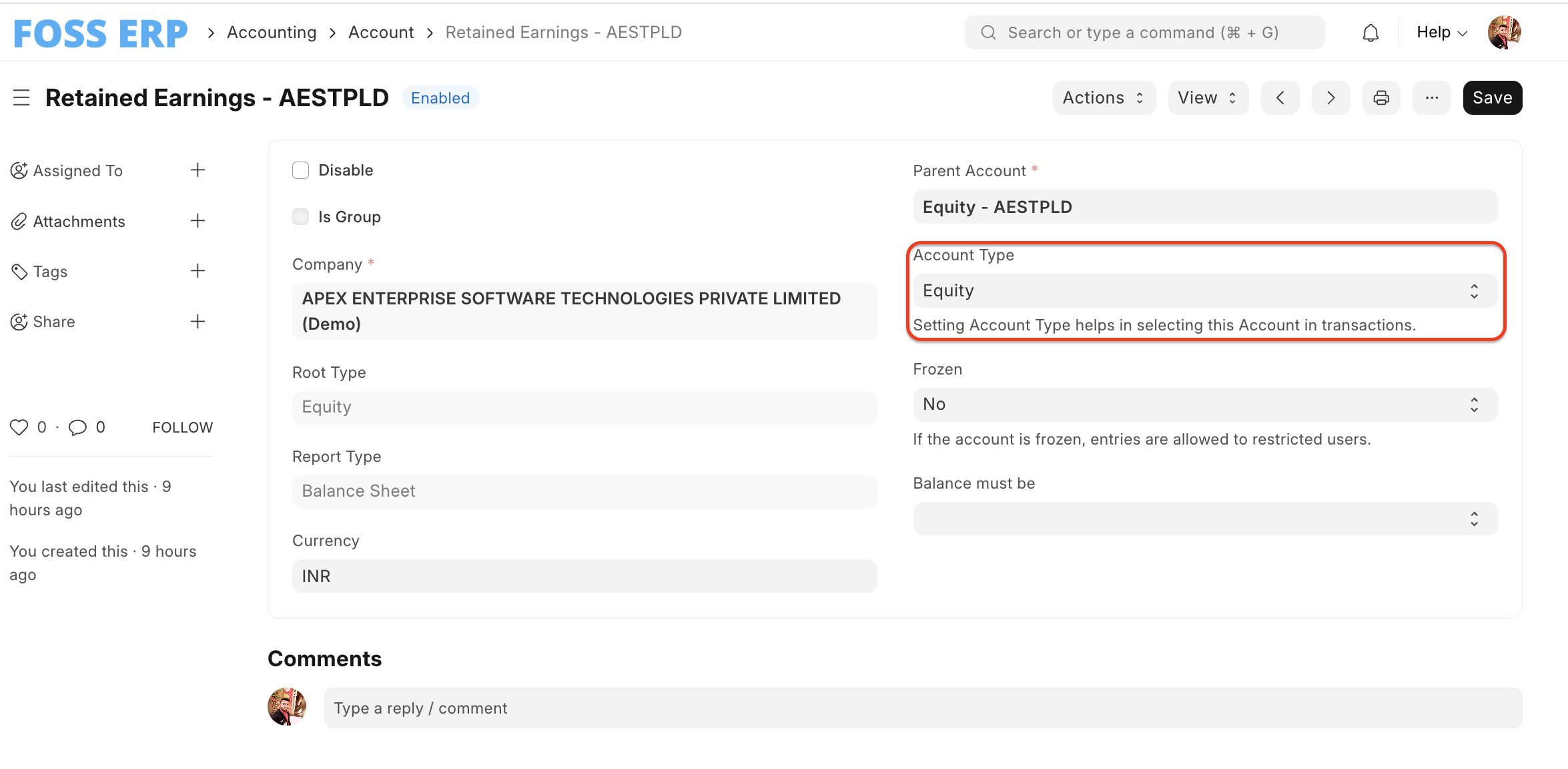

Retained Earnings

Retained earnings epitomize the cumulative net profits that an organization elects to retain rather than disburse as dividends to shareholders. These funds are integral to fostering organizational expansion and reinvestment strategies. Retained earnings are appropriately classified within the Equity section of the balance sheet, reflecting their attribution to the proprietors of the entity.

Computational Framework:

Financial Year Beginning Retained Earnings + Net Income - Dividends Paid =Financial Year Ending Retained Earnings

Salient Features: - Located within the Equity domain of the balance sheet. - Indicative of financial robustness and reinvestment potential. - Serves as a foundational resource for capitalization and growth-oriented initiatives.

Reserves and Surplus

Reserves constitute allocations earmarked for specific strategic or precautionary objectives, such as mitigating contingencies, funding expansion, or provisioning for future dividend distributions. Surplus, on the other hand, denotes the aggregation of undispersed profits.

Account Classification: Reserves and Surplus accounts are systematically positioned under the Liabilities section in the balance sheet.

Merits of Reserves and Surplus: 1. Act as a primary reservoir of capital for operational and strategic undertakings. 2. Provide a safeguard against financial adversities during periods of suboptimal performance. 3. Facilitate consistent dividend payouts by compensating for interim shortfalls.

Limitations of Reserves and Surplus: 1. Susceptible to manipulation for obscuring operational deficits within financial disclosures. 2. General reserves, due to their non-specific allocation, may be vulnerable to misappropriation.

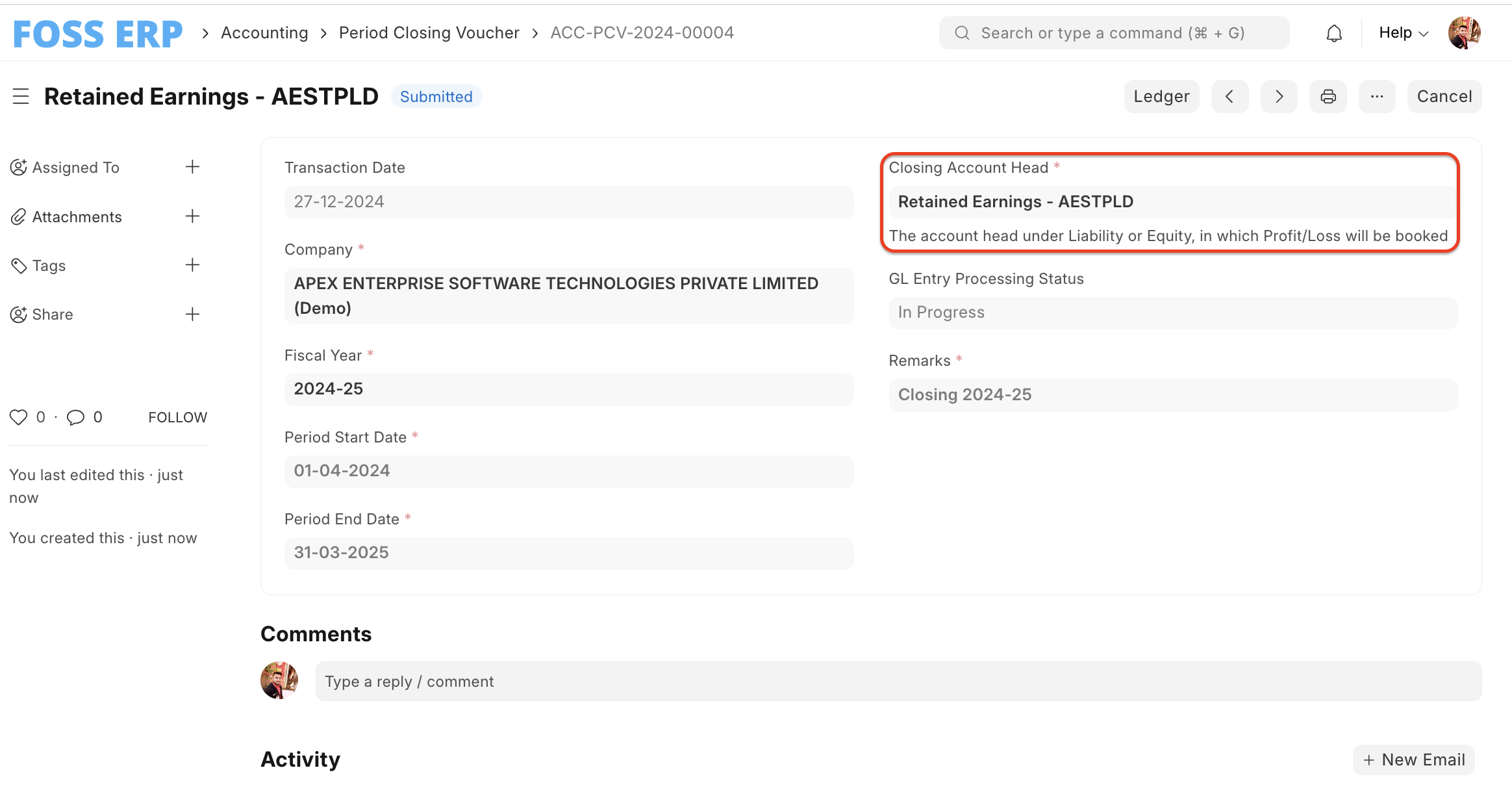

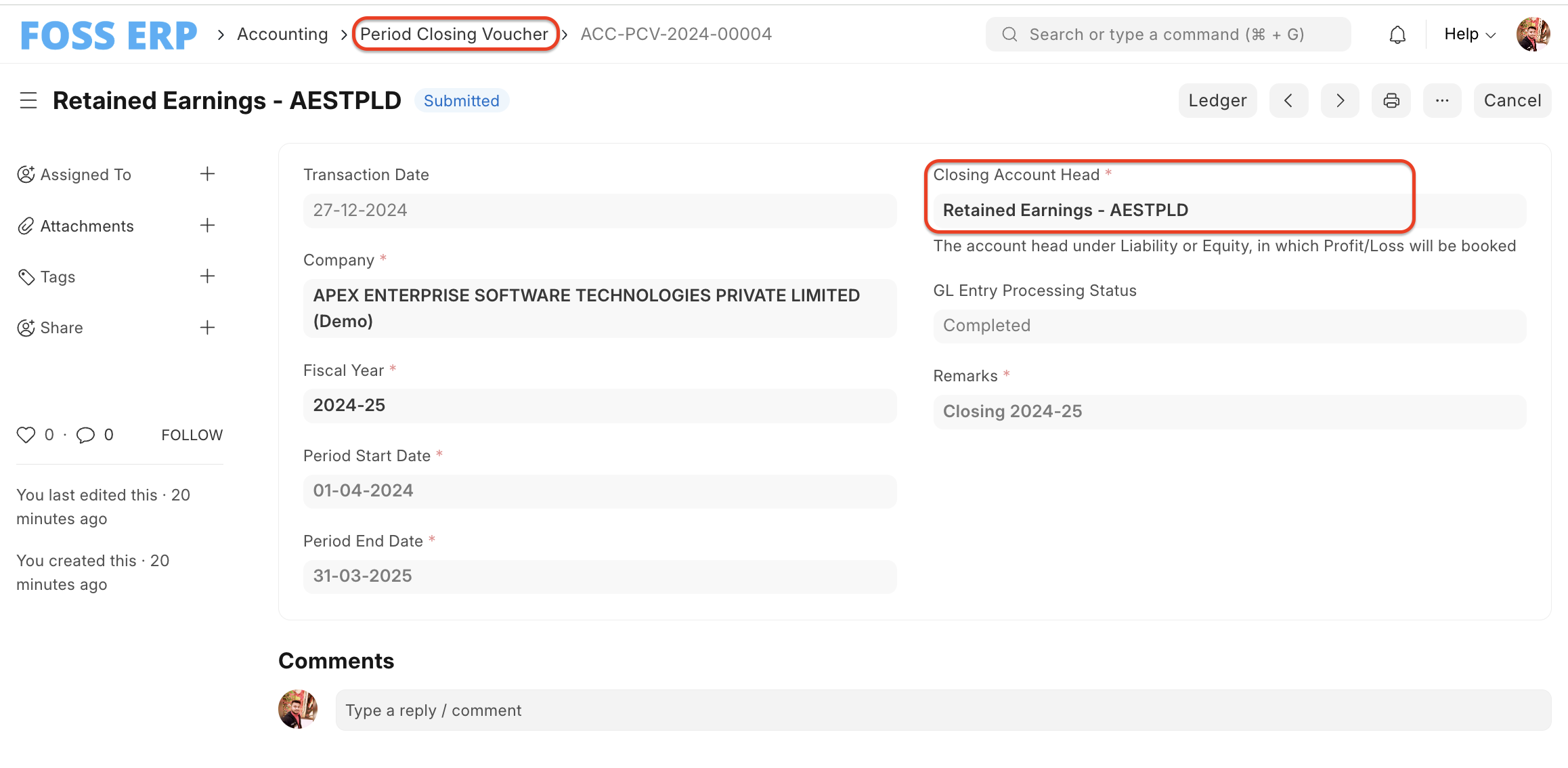

Operational Dynamics of a Period Closing Voucher

Upon the execution of a Period Closing Voucher, the accounting system autonomously generates General Ledger (GL) Entries to:

- Reset the balances of all income and expense accounts to zero.

- Allocate the resultant profit or loss to a designated liability or equity account, including:

- Reserves and Surplus

- Revenue Reserve

- Owner’s Capital Account

This process substantiates the accuracy of financial statements by delineating the organization’s performance metrics and financial position at the closure of the fiscal interval.

Conclusion

The Period Closing Voucher serves as an indispensable instrument within the accounting domain, facilitating the systematic closure of fiscal periods, ensuring the precision of financial records, and supporting sustainable growth trajectories. By appropriately categorizing and managing retained earnings alongside reserves and surplus, organizations can uphold transparency, reinforce compliance with best practices, and solidify their financial foundations for long-term viability and resilience.

It's nicely explained. Great work, keep doing it.