Simplify Global Financial Operations with ERPNext’s Multi-Currency Accounting

In today’s interconnected economy, businesses often operate across borders, managing transactions in multiple currencies. Helps handle international invoices to automate exchange rate calculations.

1). Why Multi-Currency Accounting?

For businesses dealing with global customers, suppliers, or branches, multi-currency accounting is essential. Here’s why:

- It facilitates transactions in different currencies without manual intervention.

- Ensures compliance with international accounting standards.

- Simplifies financial reporting, reflecting balances and transactions in the respective currencies.

Whether it’s a foreign bank account or cross-border supplier payments, multi-currency accounting is the backbone of efficient global finance management.

2). Key Benefits of ERPNext’s Multi-Currency Accounting

💰 Seamless Currency Management

ERPNext enables businesses to raise invoices, track payments, and maintain accounts in multiple currencies while ensuring accurate conversions.

🔖 Automatic Exchange Gain/Loss Handling

- Automatically calculates exchange differences between invoices and payment entries.

- Posts realized exchange gains or losses directly to the appropriate account.

💹 Real-Time Exchange Rate Updates

- Fetches exchange rates dynamically during transactions.

- Reflects fluctuations in real-time for accurate accounting.

🛠 Advanced Integration Capabilities

Option to integrate APIs like Frankfurter for fetching exchange rates based on transaction posting dates.

3). How to Set Up Multi-Currency in ERPNext?

Setting up multi-currency in ERPNext is straightforward. Follow these steps to ensure your system is ready for global operations:

1️⃣ Supplier and Creditor Configuration

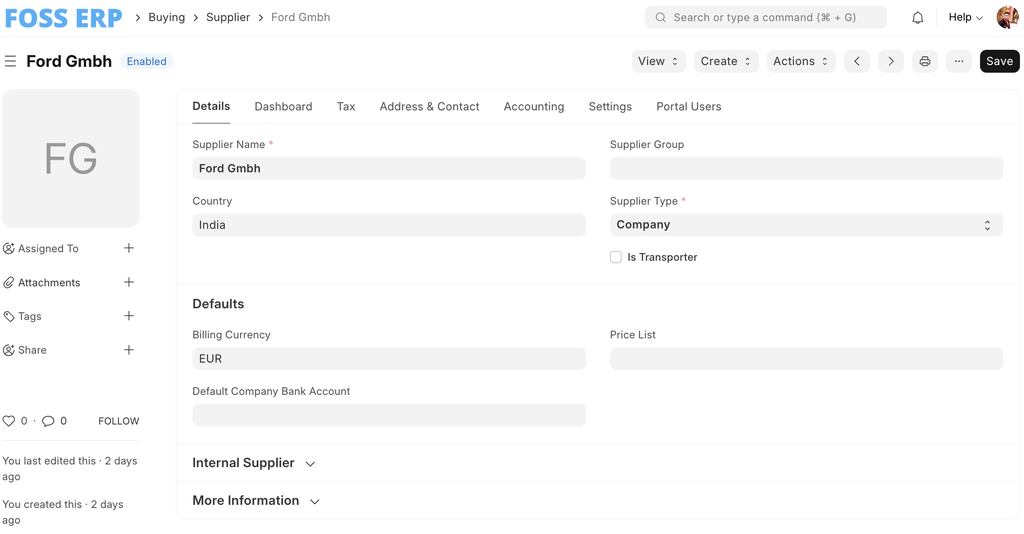

- Create a Supplier: Assign the desired billing currency to the supplier.

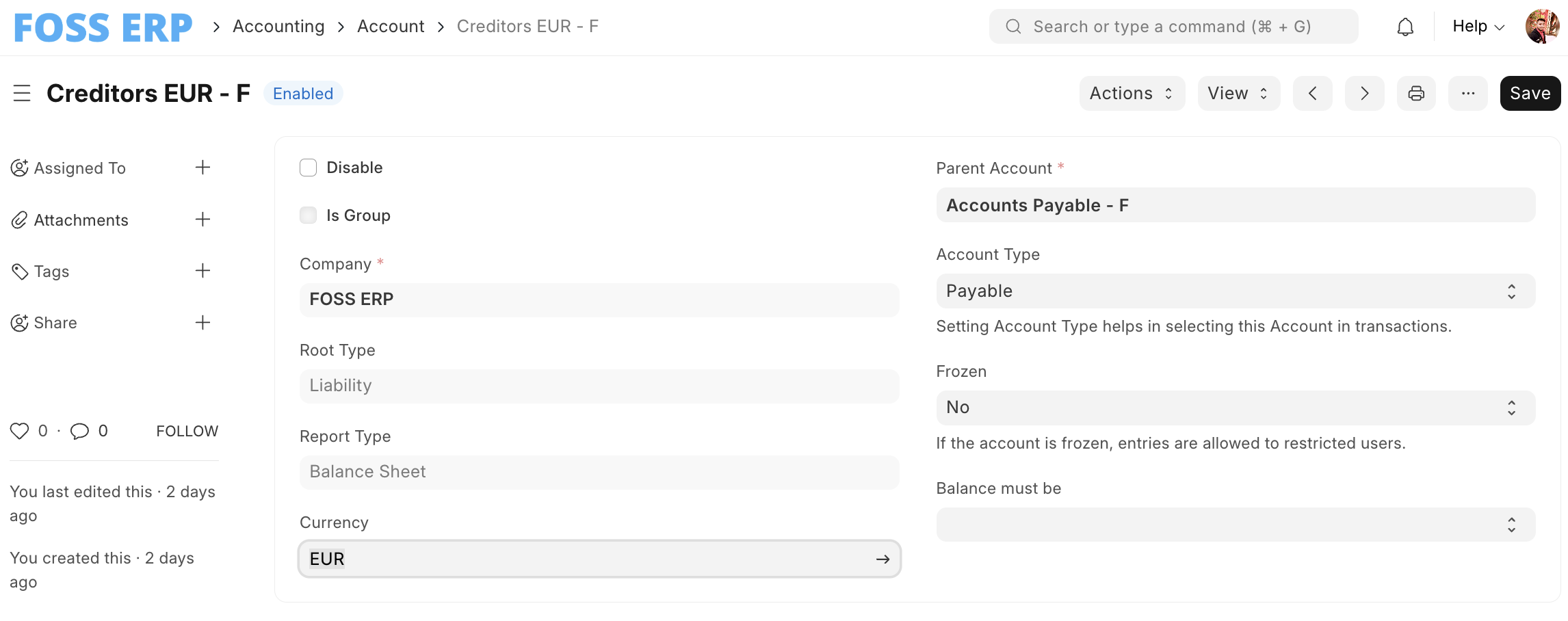

- Set Up Creditor Account:

- Add a creditor account under the chart of accounts.

- Set the Account Type to Payable and specify the supplier’s billing currency.

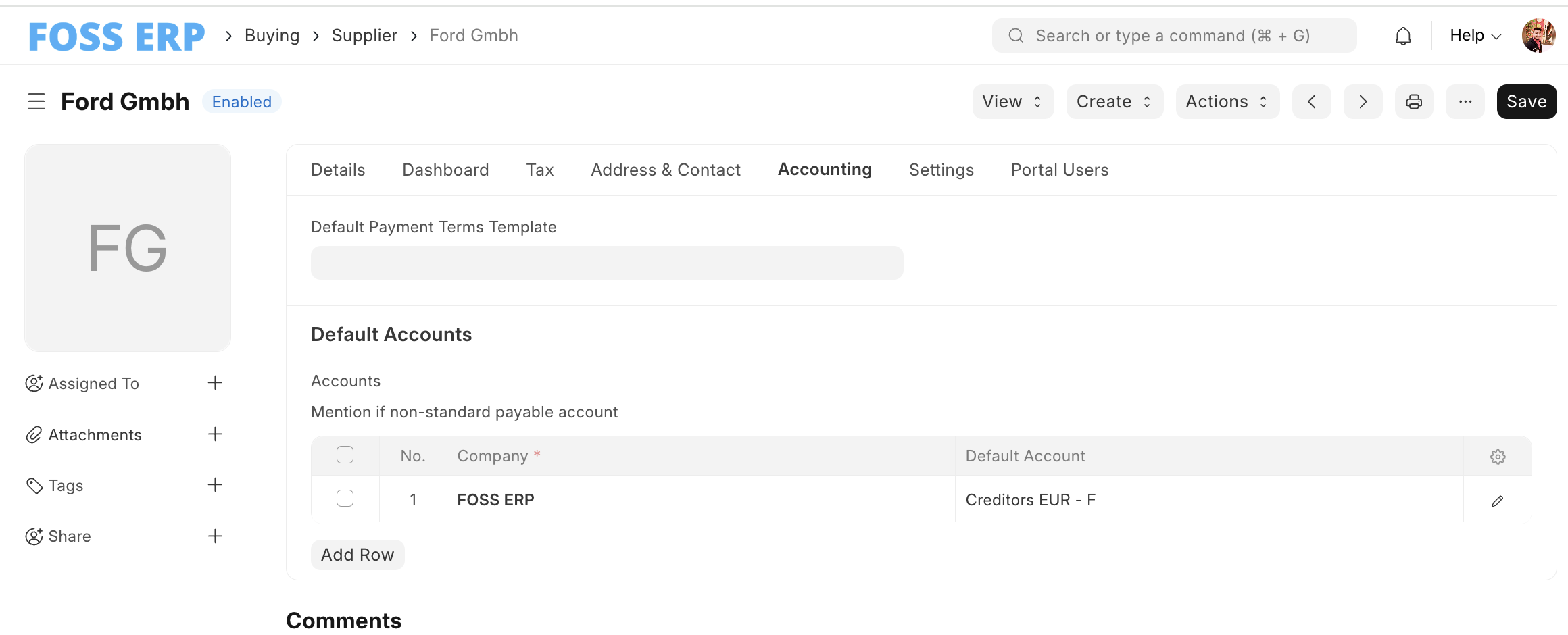

- Map the Account: Link the creditor account to the supplier for streamlined transactions.

2️⃣ Bank Account Setup

- Foreign Bank Account: Create a bank account under current assets in the chart of accounts.

- Set the Account Type to Bank.

- Assign the currency (e.g., EUR).

- This setup ensures accurate tracking of foreign currency balances.

4). Prerequisites for Multi-Currency Transactions

Before transacting in multiple currencies, ensure the following:

1. Supplier and bank accounts are configured with the appropriate currencies.

2. Exchange rates are sourced consistently, whether from purchase orders or integrated APIs.

Example Workflow:

- Create a purchase order.

- The system fetches the exchange rate and applies it to the purchase receipt and invoice.

- For payments, the exchange rate is dynamically fetched based on the payment entry’s posting date.

- Exchange differences are automatically posted to the Realized Exchange Difference account.

5). Additional Features in ERPNext

1. Automated Journal Entries for Exchange Differences

ERPNext V15 simplifies accounting further by creating auto-journal entries for realized exchange gains or losses.

2. Real-Time Integration

Use APIs like Frankfurter for dynamic exchange rate fetching based on transaction dates.

3. Customizable Financial Reports

Generate detailed financial reports reflecting balances in base and foreign currencies, providing clear insights into global finances.

6). Conclusion

ERPNext’s multi-currency accounting feature empowers businesses to operate globally without worrying about currency complexities. Its automation, real-time tracking, and advanced integration capabilities make it the ideal solution for handling multi-currency transactions efficiently.

By enabling seamless invoicing, accurate exchange rate calculations, and transparent reporting, ERPNext helps businesses maintain financial clarity and confidence in a global marketplace.

Start leveraging ERPNext’s multi-currency accounting today and simplify your global financial operations!

No comments yet. Login to start a new discussion Start a new discussion