Asset Capitalization and Decapitalization: A Detailed Analysis

Capitalization and decapitalization are indispensable components of comprehensive asset management, offering a nuanced approach to aligning financial records with operational realities.

Introduction

The meticulous management of assets is a cornerstone of sophisticated financial reporting and regulatory adherence. Among the various facets of asset management, capitalization and decapitalization are pivotal processes that ensure an organization’s financial statements accurately reflect its economic reality. This analysis delves into these processes, elucidating their conceptual underpinnings, practical implementations, and strategic significance.

Conceptualizing Asset Capitalization

Asset capitalization is the accounting treatment whereby expenditures that yield benefits over multiple accounting periods are recognized as assets on the balance sheet rather than as immediate expenses on the income statement. This approach encapsulates the principle of matching expenses with the revenues they generate, ensuring a rational portrayal of financial performance.

The Rationale for Asset Capitalization

- Enhanced Financial Precision: By deferring costs over the asset’s useful life, capitalization ensures congruence between expenses and the economic benefits derived.

- Optimized Tax Positioning: Capitalized assets are depreciated systematically, potentially offering long-term tax advantages.

- Investment Oversight: Recording significant expenditures as assets facilitates rigorous tracking of capital investments and their operational impact. -

Illustrative Example

Consider the acquisition of industrial machinery for $50,000, projected to have a utility span of 10 years. Instead of immediately expensing the total cost, the expenditure is capitalized and amortized through annual depreciation charges of $5,000, aligning with the asset’s productive contribution.

Decoding Asset Decapitalization

Conversely, asset decapitalization involves the systematic removal of a capitalized asset from the balance sheet. This process is precipitated by the sale, disposal, or obsolescence of an asset, ensuring that financial records accurately depict the organization’s asset portfolio.

Imperatives for Asset Decapitalization

- Maintaining Balance Sheet Integrity: Removing redundant or non-operational assets upholds the reliability of financial statements.

- Gain/Loss Recognition: Decapitalization enables the explicit identification of financial outcomes from asset disposals.

- Compliance with Accounting Standards: Adhering to protocols for asset retirement ensures alignment with frameworks such as GAAP and IFRS.

Illustrative Example

Imagine the aforementioned machinery, now sold after 8 years for $10,000. By this time, $40,000 in accumulated depreciation has been recorded, leaving a net book value of $10,000. The decapitalization process entails removing the asset’s book value and recognizing any financial implications, in this case, neither gain nor loss.

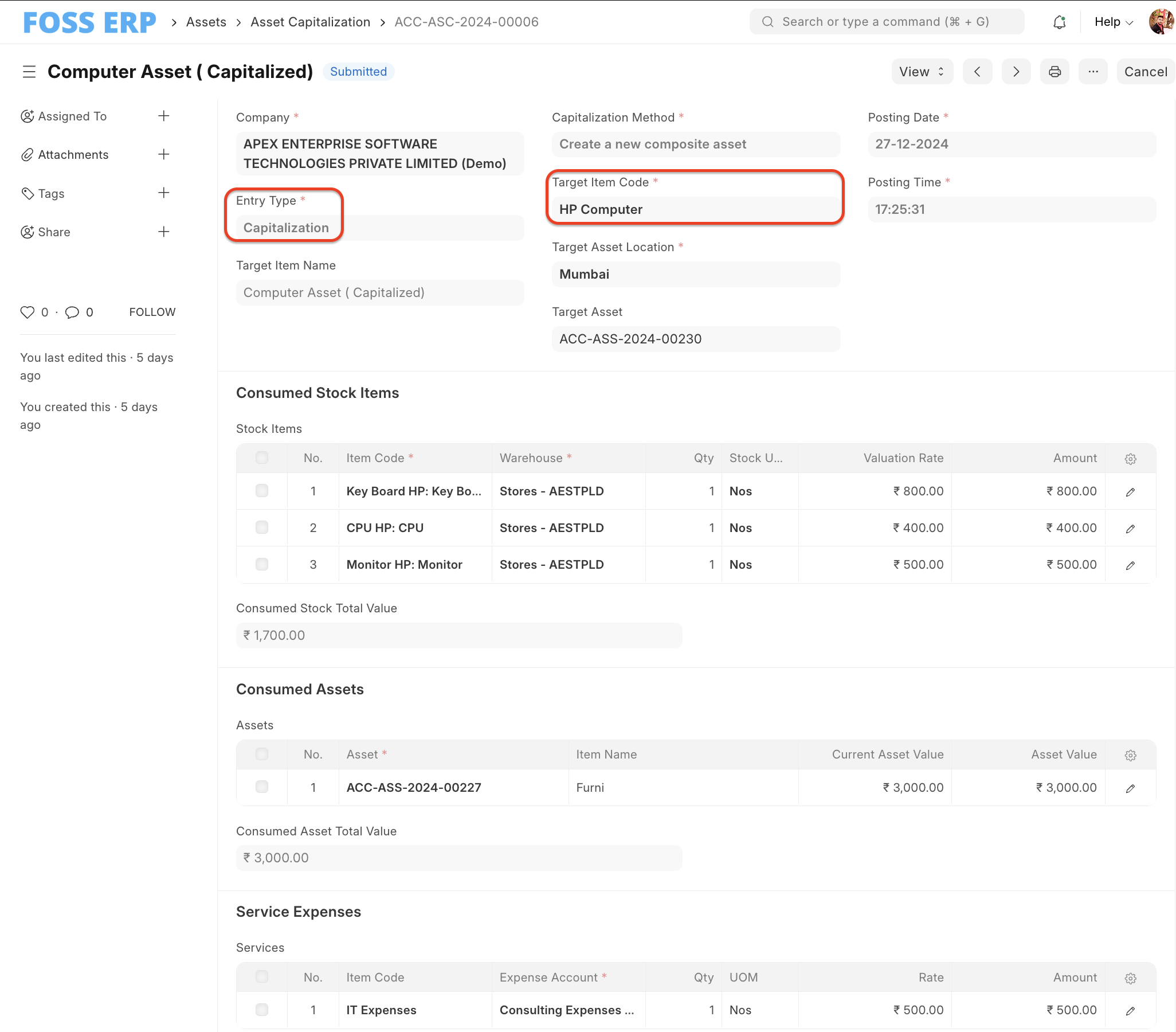

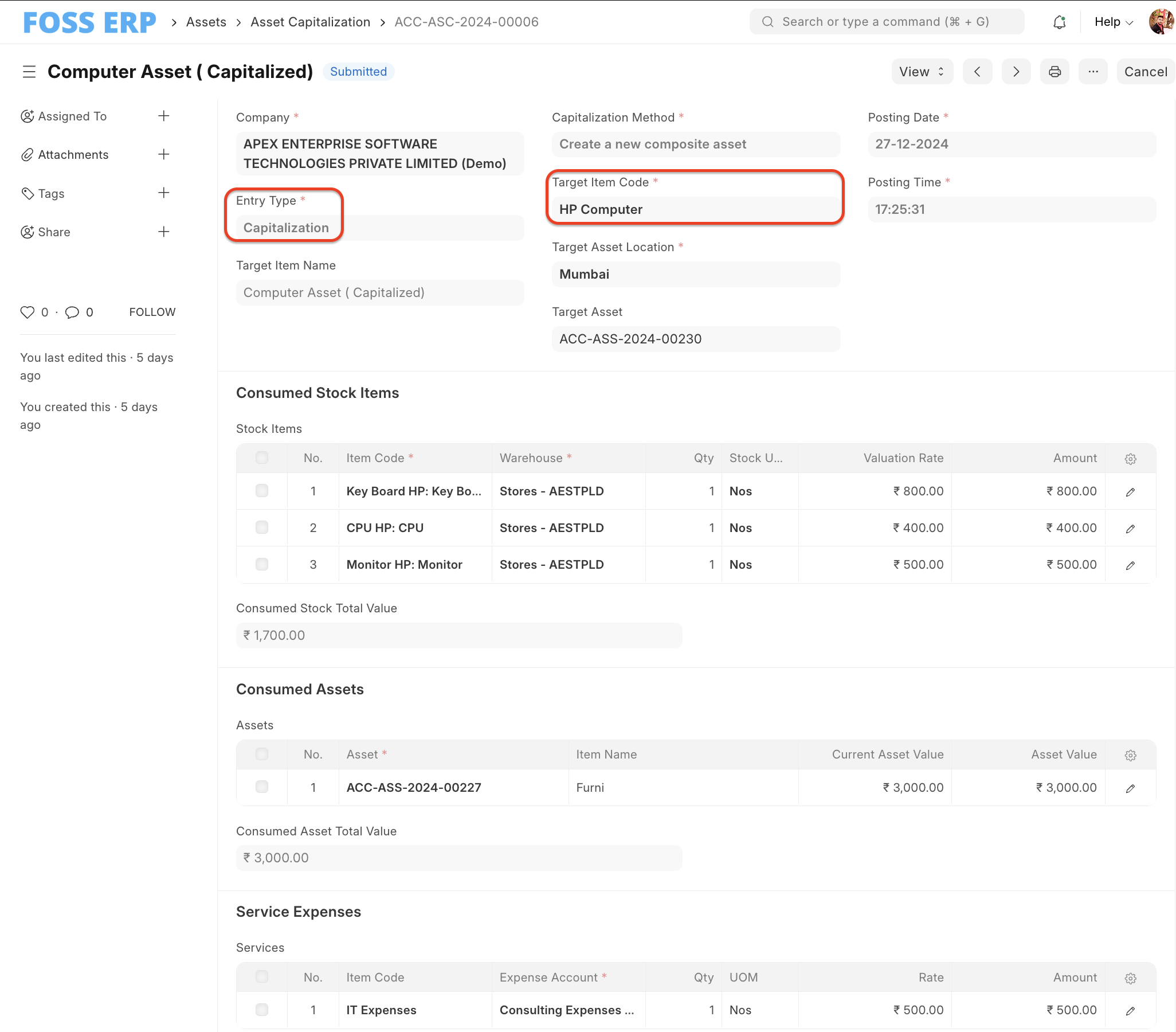

Operationalizing Capitalization and Decapitalization in ERPNext

Capitalization Workflow

- Asset Acquisition: Document the purchase within the “Assets” module.

- Data Input: Record essential details, including asset description, purchase date, and cost.

- Depreciation Framework: Define the depreciation method and useful life.

- Activation: Enable ERPNext to monitor the asset’s depreciation trajectory.

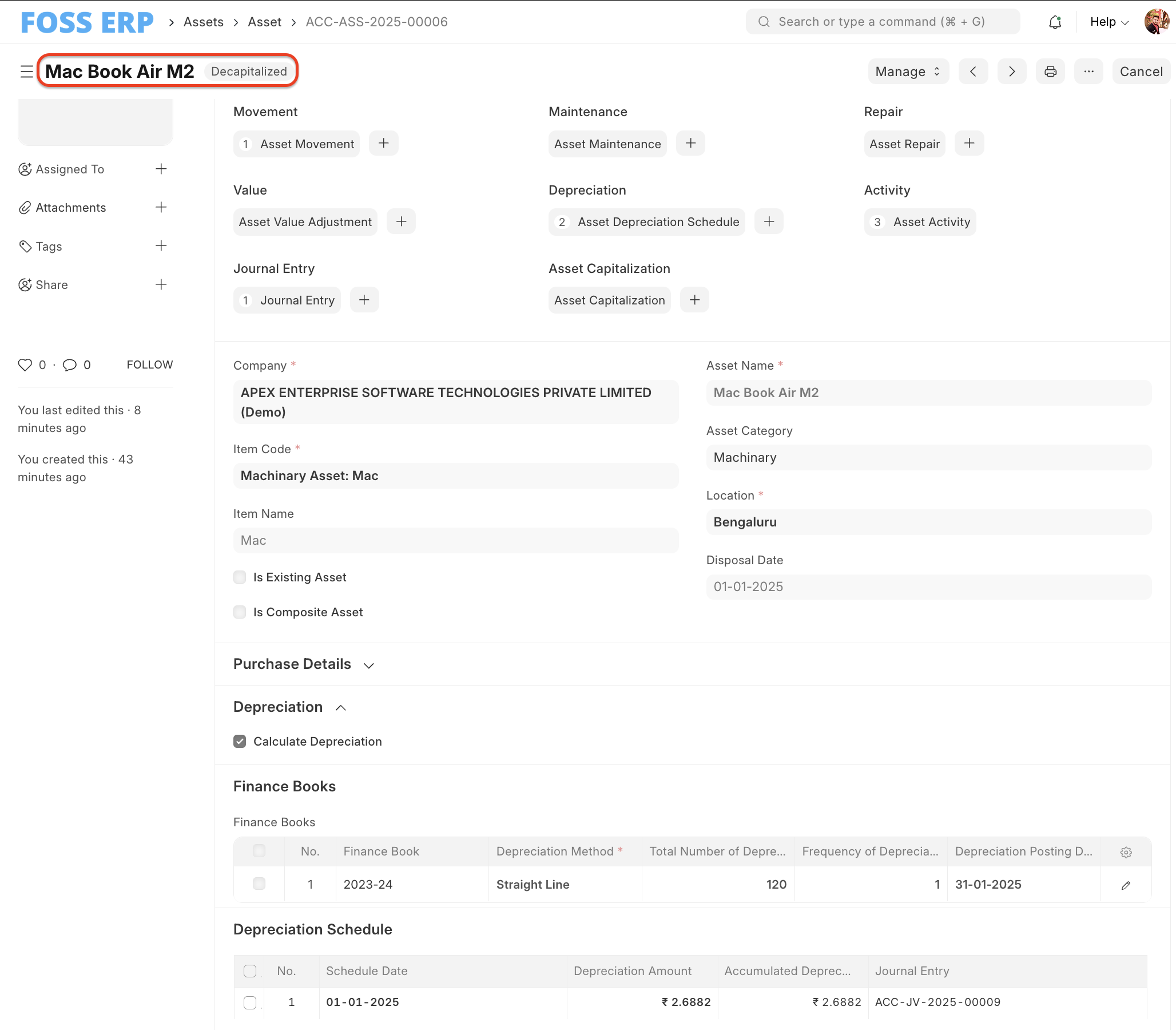

Decapitalization Workflow

- Initiate Retirement: Select the asset for retirement or sale in the “Assets” module.

- Detail Disposal: Input disposal specifics, such as date, reason, and proceeds.

- Adjust Depreciation: ERPNext recalculates accumulated depreciation up to the disposal date.

- Journal Entry Generation: The system records the removal of the asset’s book value and any resultant financial effects.

Salient Considerations

- Dichotomous Nature: While capitalization integrates assets into the balance sheet, decapitalization excludes them, marking their lifecycle culmination.

- Accounting Entries:

- Capitalization: Debit the asset account; credit cash or accounts payable.

- Decapitalization: Credit the asset account; debit accumulated depreciation and record any gain or loss.

- Regulatory Adherence: Both processes demand stringent compliance with applicable accounting frameworks.

Conclusion

Capitalization and decapitalization are indispensable components of comprehensive asset management, offering a nuanced approach to aligning financial records with operational realities. Tools such as ERPNext streamline these processes, enabling organizations to uphold precision and transparency in their financial disclosures. For businesses navigating the complexities of asset management, mastering these processes is integral to sustaining fiscal discipline and strategic agility.

No comments yet. Login to start a new discussion Start a new discussion